To calculate interest, start by determining the principal, which is the amount of money you'll be calculating interest on. Next, determine the interest rate, which was agreed upon at the outset and should be presented in a decimal number for calculation.

To calculate interest, start by determining the principal, which is the amount of money you'll be calculating interest on. Next, determine the interest rate, which was agreed upon at the outset and should be presented in a decimal number for calculation. Calculating interest payments is not a simple equation. Luckily, a quick search for "interest payment calculator" makes it easy to find your payment amounts as long as you know what to input into the calculator: Principal: The amount of your loan. If you loan is $5,000, the principal is $5,000.

Calculating interest payments is not a simple equation. Luckily, a quick search for "interest payment calculator" makes it easy to find your payment amounts as long as you know what to input into the calculator: Principal: The amount of your loan. If you loan is $5,000, the principal is $5,000. The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank to the borrower for the use of its assets or money for a specific time period. Understand the interest rate formula along with derivations, examples and FAQs.

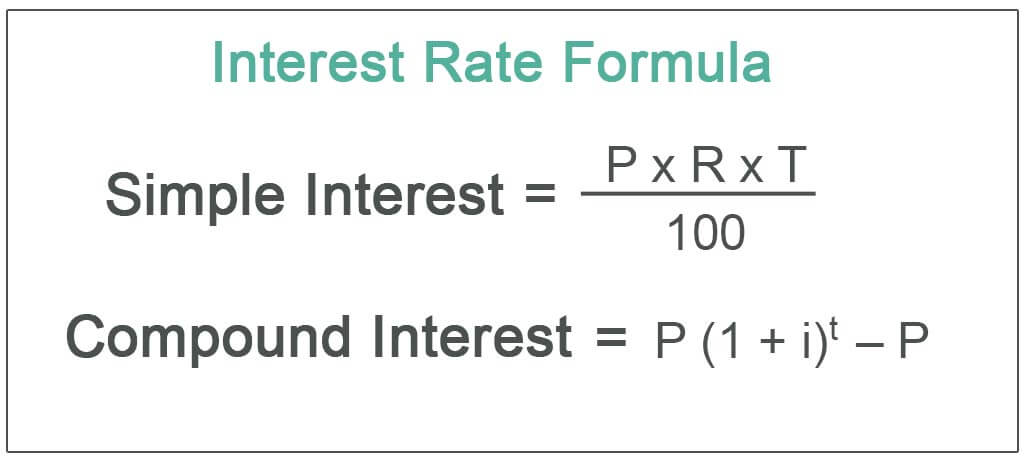

The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank to the borrower for the use of its assets or money for a specific time period. Understand the interest rate formula along with derivations, examples and FAQs. Use our interest rate calculator to work out the interest rate you're receiving on credit cards, loans, mortgages or savings. An interest rate is a percentage that is charged by a lender to a borrower for an amount of money. This translates as a cost of borrowing.

Use our interest rate calculator to work out the interest rate you're receiving on credit cards, loans, mortgages or savings. An interest rate is a percentage that is charged by a lender to a borrower for an amount of money. This translates as a cost of borrowing. Download FREE Interest Rate Formula Excel Template and Follow Along! An interest rate formula calculates the repayment amounts for loans and interest over investment on fixed deposits, mutual funds, etc. It is also used to calculate interest on a credit card.

Download FREE Interest Rate Formula Excel Template and Follow Along! An interest rate formula calculates the repayment amounts for loans and interest over investment on fixed deposits, mutual funds, etc. It is also used to calculate interest on a credit card.